The only way to achieve prosperity is to be conscious of every penny.

Oh diba, it rhymes? Haha!

Well, unless you're the heir of Henry Sy or plan to marry some millionaire dude. But you and I know that's not what I mean.

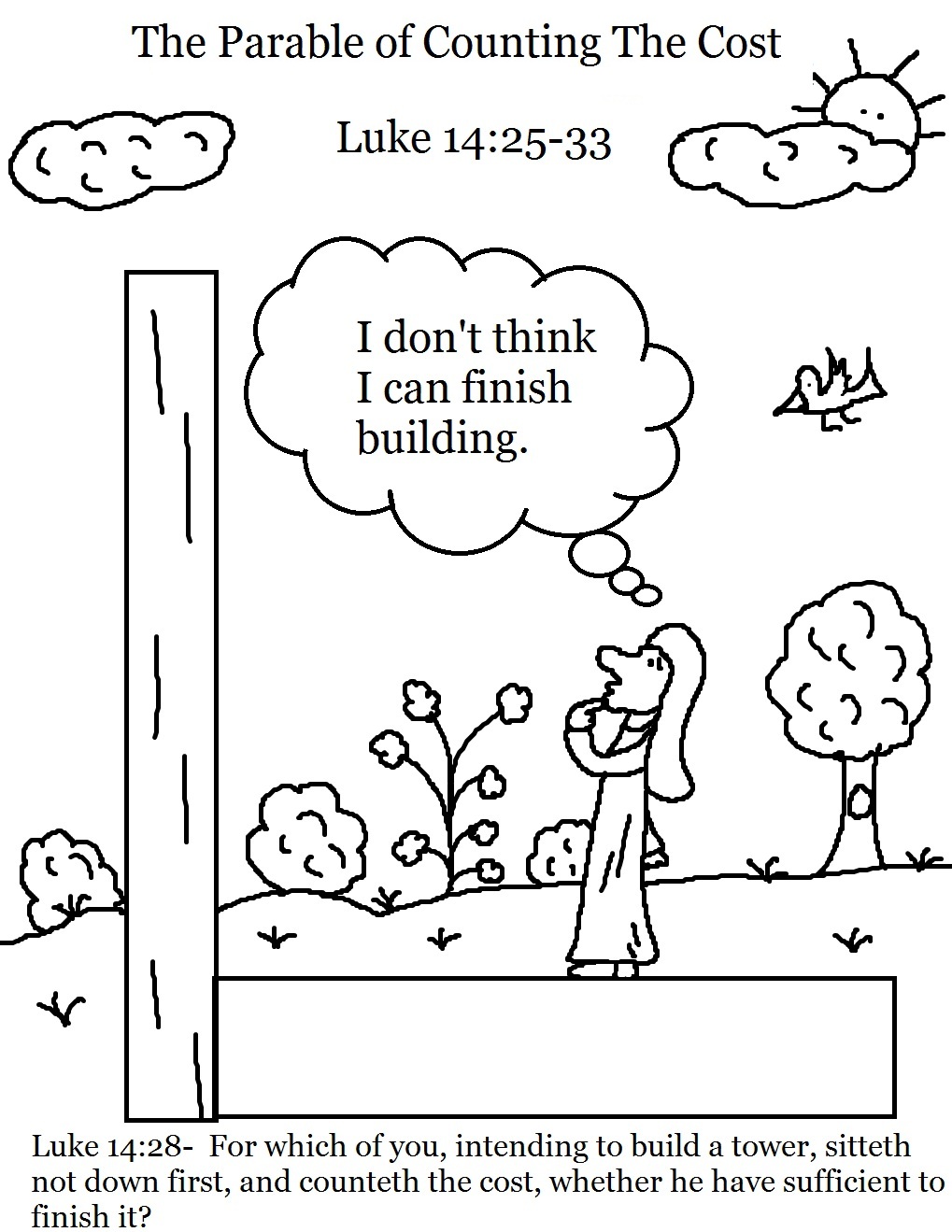

|

| Photo: brucegerencser.net |

Without stressing the importance of tracking money, it is hard to know what your true money habits are. Then you'll be forever trapped in the web of lies that tells you you can't give or you can't save because you don't have enough.

Thus the domino effect of not tithing and not creating an emergency fund.

Thus the absence of prosperity and the presence of a poverty mindset (which, again, keeps you from giving). It's a vicious cycle!

It might seem like such a small detail, but tracking where every peso is spent goes a long way. Trust me. Here are the things you need to know.

1. What is money tracking?

Simple. As the name implies, it's the act of tracking your money. It means being conscious of your spending, giving, saving, and, in some cases, borrowing.

2. Why should I track my money?

You should track your money because that daily chocolate fix costs you almost P1200 a month, enough to feed a family of five, and you might not even know it. And that's just chocolate. What if you have a daily Starbucks fix?

A. Seriously, it's hard to remember the "small" expenses. While it's easy to take note of expensive purchases, sometimes, what really makes a dent on our budgets - and what keep us from tithing and saving - are the petty little things that keep adding up.

For example, I know the "big things" we pay for every month like bills and mortgage. However, I recently found out that it's food (groceries mostly!) that makes up the bulk of my expenses! Gulp. Studying my tracker, I also realized that some of them are unnecessary or frivolous expenses. Through tracking, I now know that I need to slice off some expenses from that area.

B. Another thing that makes tracking important is how it helps you see what you need to spend money on. You see, aside from allowing you to see the unnecessary expenses, it also allows you to see necessary expenses that you might not have previously accounted for.

For example, I used to not include transportation in my budget. This is because it seemed so insignificant since I work from home. However, when I do commute, I need to take a taxi cab especially if I bring Yuri along. When I studied my tracker, I found out that when added up, my transportation expenses did make up a significant amount. Through tracking, I now know to include transportation in my budget.

C. Finally, through tracking, it would be easier to create a realistic budget. Since it makes you see both your necessary and unnecessary expenses, you will now know how much you should allot for each aspect (To know what these aspects are, please visit this post).

|

| Photo: http://www.churchhousecollection.com/ |

On the other hand, I realize that I do spend a significant amount on transportation, making it a necessary expense. Because of this, I now know to include transportation in my budget.

Why is this important? You now know how to balance your budget. If transportation used to be something I didn't account for, there's a chance that I might not have budget for it. There might come a time when I can't step out of the house since I don't have money for transportation.

On the flip side, since I now know I should decrease my expenses in food and groceries, I will have something to allot for transportation! Balance for the win!

D. Most importantly, being aware of your expenses and spending habits and now knowing what to change will make you realize that you (YES, YOU!) can tithe and can save! Enough with mindless purchases; it's time to do something actually sensible with your money.

3. Okay, okay, I get it. So how do I do it?

It's really very easy actually. All you need to do is take note (literally) of all your transactions. This includes each time you spend money, give money, save, and borrow.

Here's an example:

April 2: Dinner delivery - P300

Tip - P30

April 3: Fare to office - P50

Convenience Store (milk and cookies) - P43

Payment for utang - P200

That's just a sample entry. I know it doesn't make sense. Milk and cookies? Sorry haha. The point is to write down each time you did something with your money.

You can use an old notebook or a cell phone app to do this. It doesn't matter as long as it does the job.

Personally, I use both methods: I track my money using my planner and using a phone app. It's really easy. Think of it as having a money diary!

When I was a freshman in college (oh nostalgia), I used index cards because my mom bought me a pack and I realized we're never going to use them in class. I would place it on my desk and wrote down all of my expenses. It really helped me save money. It isn't a lot for me now but it certainly mattered to a starving college student!

It's a great thing that you're reading this at the beginning of the month when you (hopefully) didn't make a lot of expenses yet. I challenge you to track your money beginning today!

Cheers to prosperity!

|

| Photo grabbed from Pinterest |

_________________________________________________________________

Do you like this post? Never miss out again when you click on the cute bunny below:

Or by entering your email here: